Transform Disjointed Middle Office Operations in Insurance

Create a fully connected insurance ecosystem by seamlessly

integrating with your Insuretech

Trying to Solve Any of These Challenges?

Disparate Systems

Slow Time-to-Develop

Mounting Technical Debt

Poor Self-Service

Crumbling Legacy Systems

Heavy Customization

Solve Multiple Problems for Insurance

on One Platform

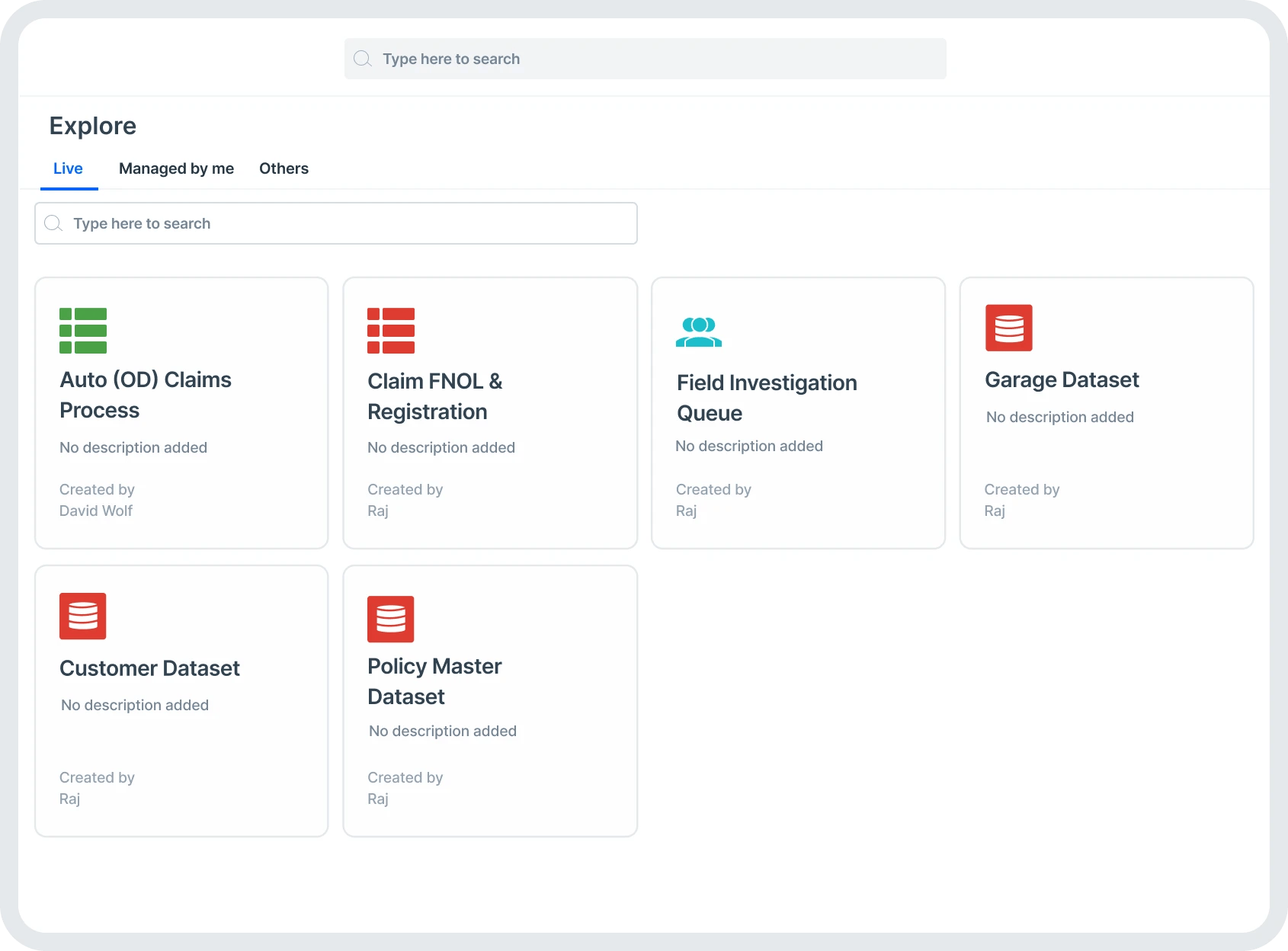

Kissflow is a low-code no-code work platform that brings the right people to

build the right apps on the right platform

Bring everything together

Break monoliths and consolidate your architecture with easily composable apps

Slash development time

Build custom apps with a powerful drag and drop app builder in weeks

Cut IT costs

Minimize technical debt and slash sunk IT costs by reducing reliance on IT

Improve self-service

Build custom apps, processes, and portals that promote self-service

Modernize legacy systems

Build new systems around the edges of your legacy systems

Connect multiple apps

Enjoy a cross-platform experience by connecting your core systems together

Fix the Missing Pieces of Your

Core Insurance Systems

Product Policy Approvals and Launch

Review and approve insurance products and policies. Integrate with underwriting and policy administration systems to ensure seamless data transfer and consistency across systems.

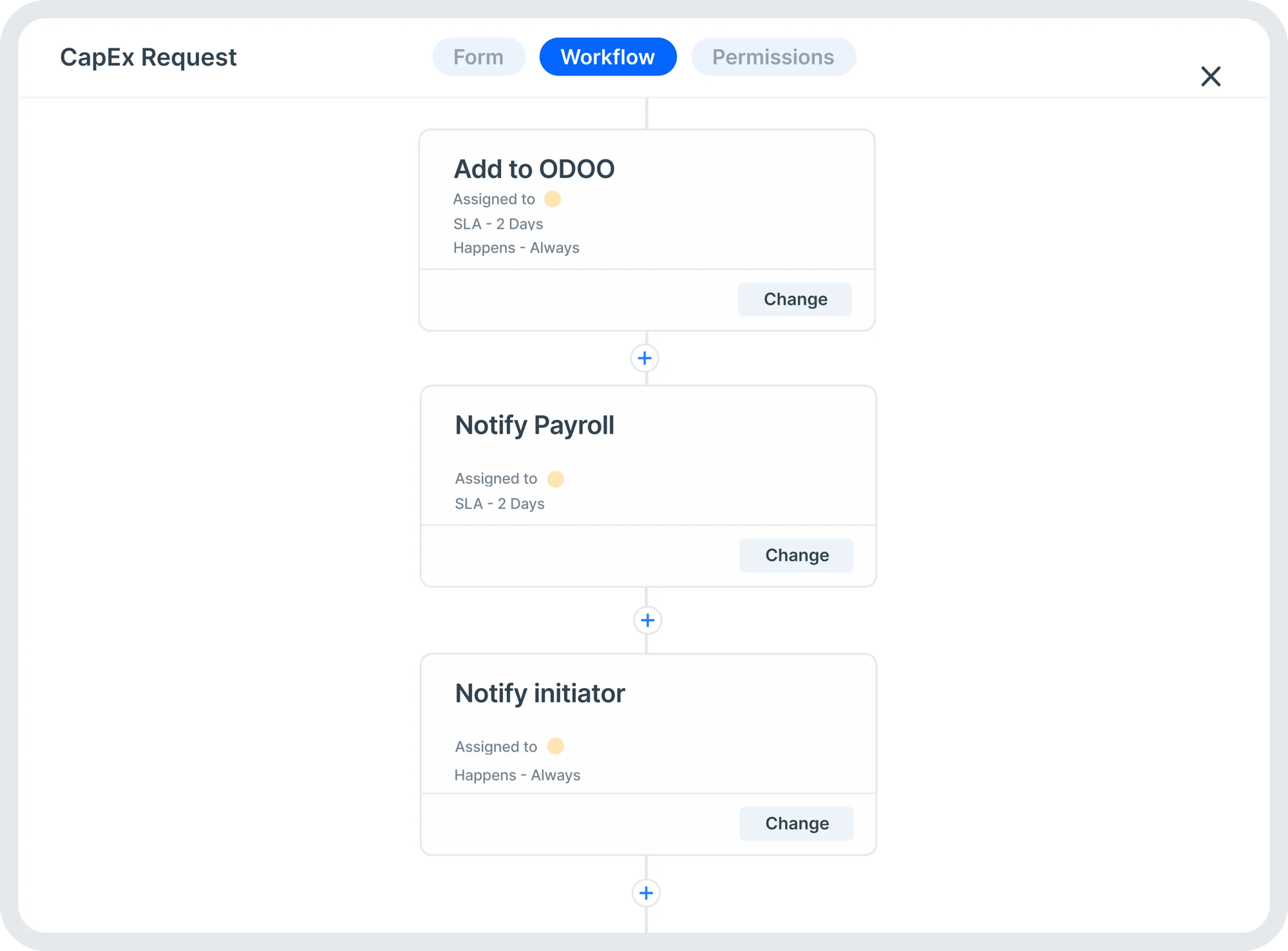

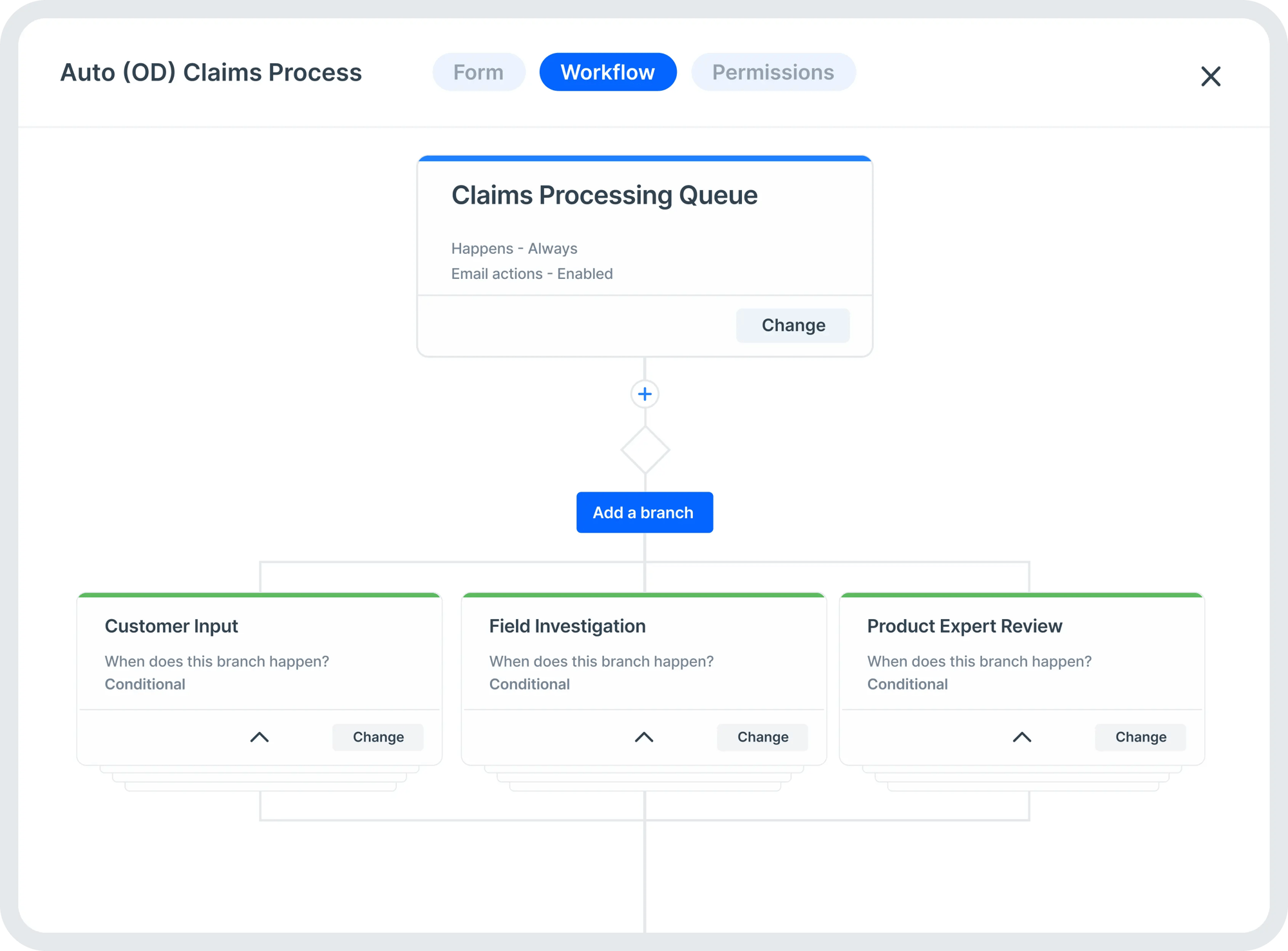

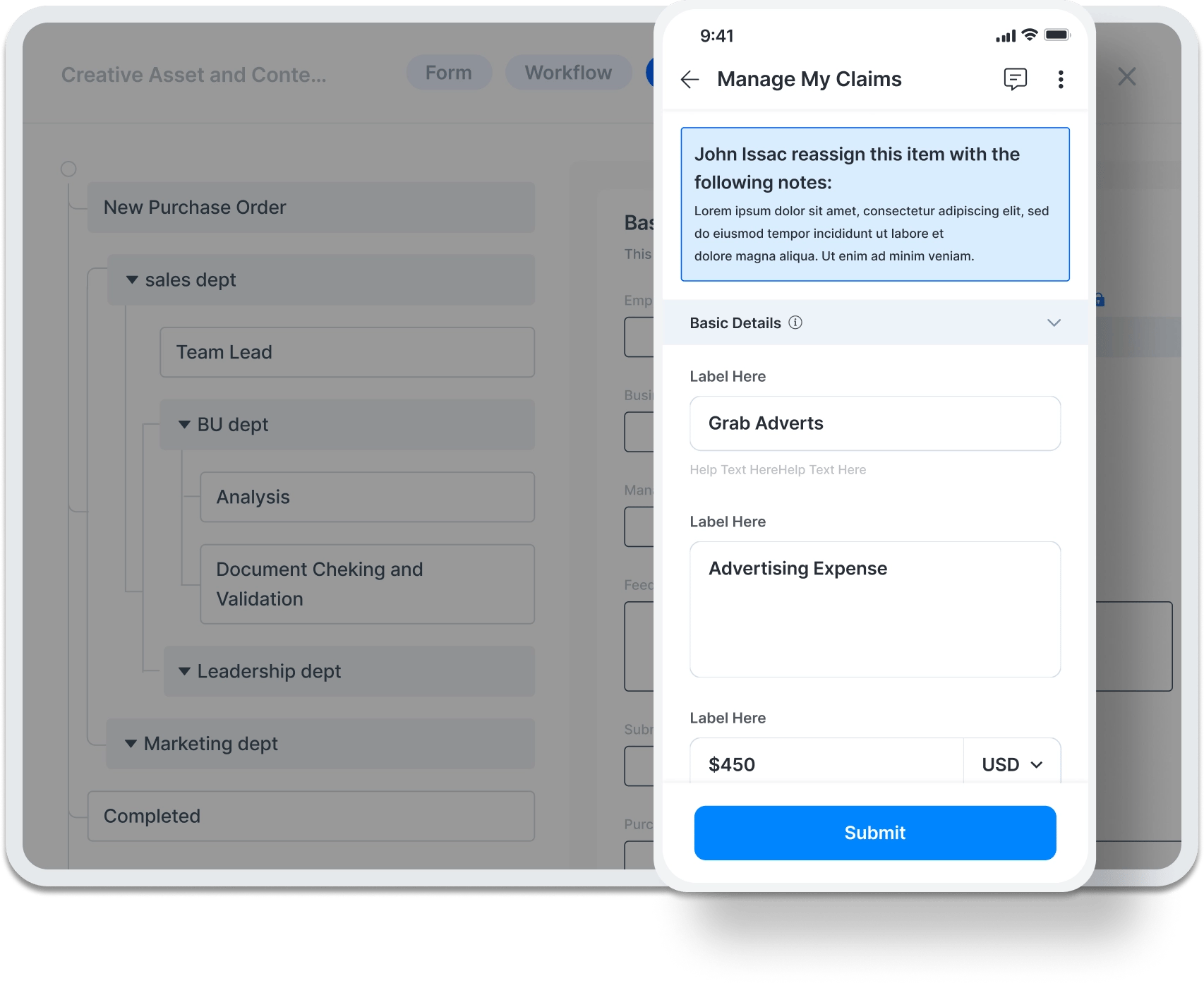

Customer Policy Approvals

Create customized workflows for policy approval processes. Allow stakeholders, such as underwriters, agents, and managers, to define the steps, roles, and responsibilities involved in reviewing and approving policies.

Policy Issuance and Dispatch

Auto-generate policies based on customer's application and underwriting process. Build custom policy templates and include policy-specific details, terms, and conditions.

Payment Reminders and Tracking

Define a schedule that determines the frequency and timing of payment reminders. In case of non-payment, include an escalation process to handle overdue payments.

New Product Launch

Automatically route the product documentation to appropriate stakeholders for review and approval, ensure all necessary approvals are obtained before the product is launched. Gain visibility into the approval status, facilitate collaboration and reduce approval cycle times.

Reinsurance

Establish clear processes with reinsurers. Provide updates on portfolio of policies, claims experience, and any significant changes in the risk profile. Exchange data and reports related to policy issuance, claims, premiums, and other relevant information via automated workflows.

Product Feedback and Ticketing

Establish a feedback loop to capture ongoing product feedback from customers, agents, and employees. Build customer surveys and feedback forms to facilitate agent feedback and customer support.

Unstructured Underwriting

Manage unstructured processes such as risk assessment, underwriting evaluation, and risk mitigation through effective case management.

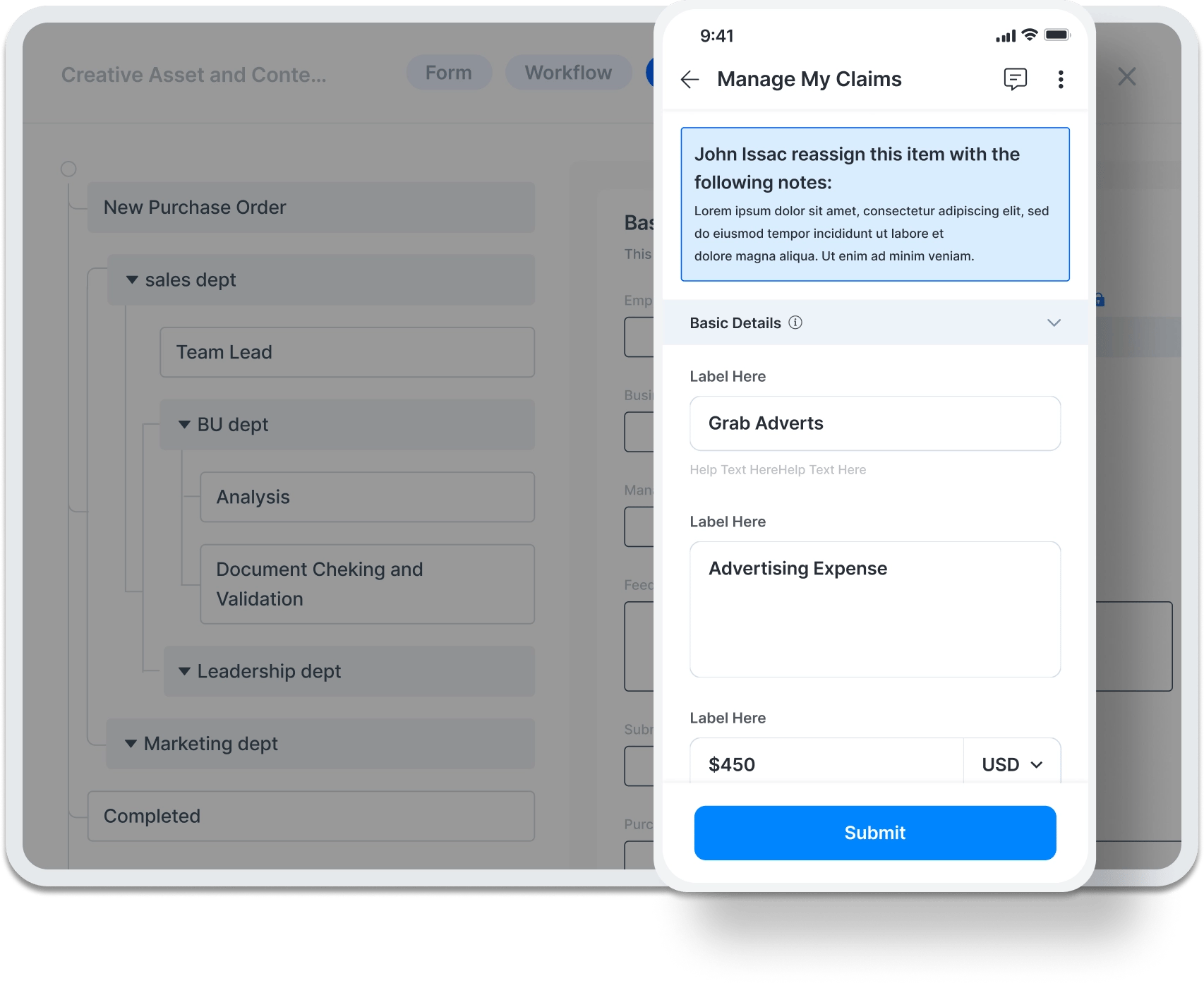

Claim Registering

Capture all necessary details related to a claim and initiate the necessary steps to assess and process it. Get notified on various channels such as phone, email, online portals, or mobile apps.

Claim Checks and Approvals

Review, validate, and approve insurance claims for payment. Intake documentation, perform initial review, assess and adjust claims, verify and authorize disbursals.

Payment and Reconciliation

Automate payments based on approved claims. Streamline reconciliation process by matching payments to corresponding claims. Compare payment amounts, claim reference numbers, policy details, and other relevant data to avoid discrepancies.

Document Management

Create a central repository for storing and organizing insurance documents. Search for documents using keywords, metadata, or advanced search options. Create workflows that support document review and approval and ensure efficient collaboration.

Vendor Onboarding

Include new vendors in your ecosystem and collaborate with them. Verify the vendor's credentials, assess their capabilities, and complete the necessary paperwork and approvals to ensure a compliant partnership.

Transportation Management

Design workflows for shipment planning, route optimization, tracking updates, and integrate it with your ERP system seamlessly.

Insurance and Renewals

Automate the entire renewal process by reviewing policy details, assessing risk factors, setting renewal terms, calculating premiums, and completing required paperwork and administrative tasks.

Fixed Asset Purchase

Streamline the process of purchasing and acquiring fixed assets. Build custom app that can automate asset requisition, approval, purchase order generation, invoice verification, asset tagging, handover and maintenance.

Event Based Messages and Reminders

Set up workflow rules within your CRM system to automatically trigger event-based messages or reminders. Integrate your CRM system with relevant data sources that contain the event information.

Policy Approval and Issuance

Auto-transfer policy issuance details from the policy administration system to CRM. Allow policyholders to submit applications through digital forms and validate it before auto syncing it with CRM.

Contact and Account Auto Sync

Allow policyholders to submit applications through digital forms and validate it before auto syncing it with CRM.

Portals and Mobile Apps

Allow policyholders to manage their policies, access information, and perform self-service tasks through custom portals and mobile apps.

Employee Onboarding

Create and manage digital documents, and enable self-service for new hires to complete onboarding work. Integrate with HR systems, such as payroll and benefits platforms, to ensure data accuracy across systems

Employee Offboarding

Build workflows and checklists to guide HR and managers through the process of employee departures. Collect feedback through exit interviews and surveys to gain insights into the reasons for employee departures.

Timesheet Management

Easily track hours worked, overtime, and paid time off. Automatically calculate time-based wages and generate detailed reports for efficient payroll processing.

Performance Management

Automate goal setting, performance appraisals and feedback processes to ensure timely completion by relevant stakeholders.

Modal title

Features That Let You Modernize Middle Office Operations

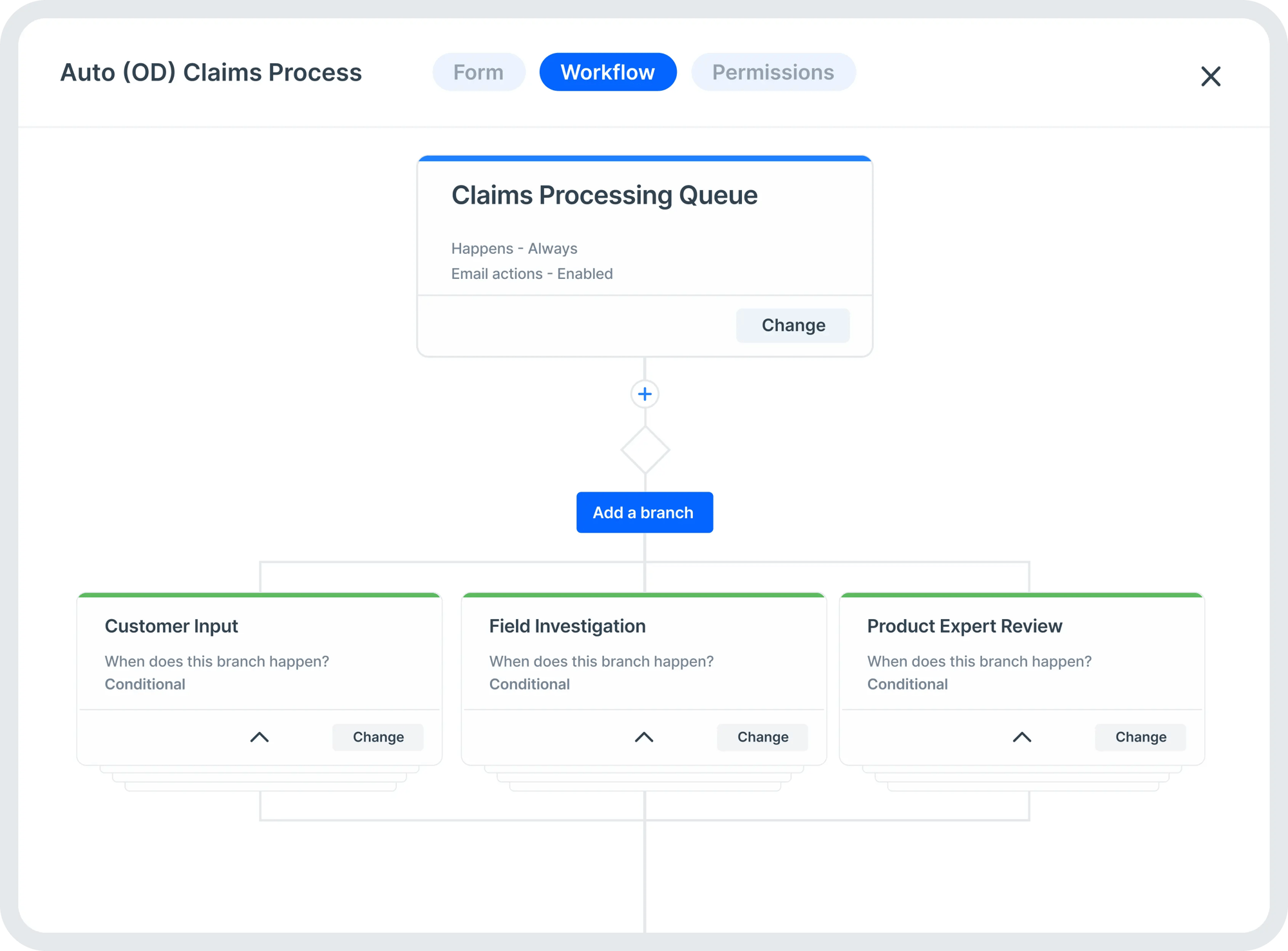

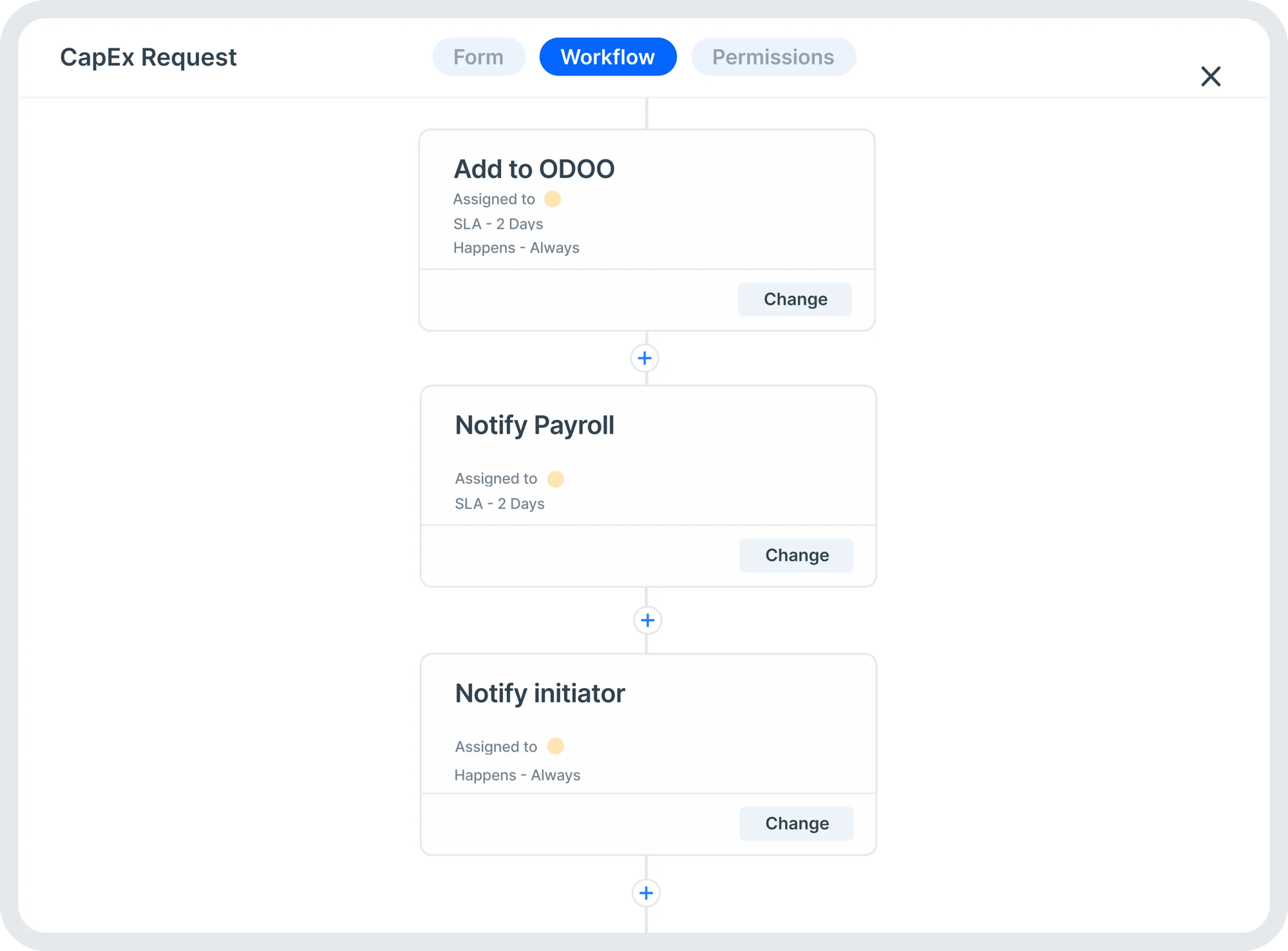

Automate Processes

Increase process efficiency by automating claims, policy administration, and underwriting functions

Orchestrate Master Data

Draw data from multiple sources, including legacy systems, and integrate it into a single database

Trigger Specific Actions

Automate emails, send notifications, approve items and implement rule-based conditions

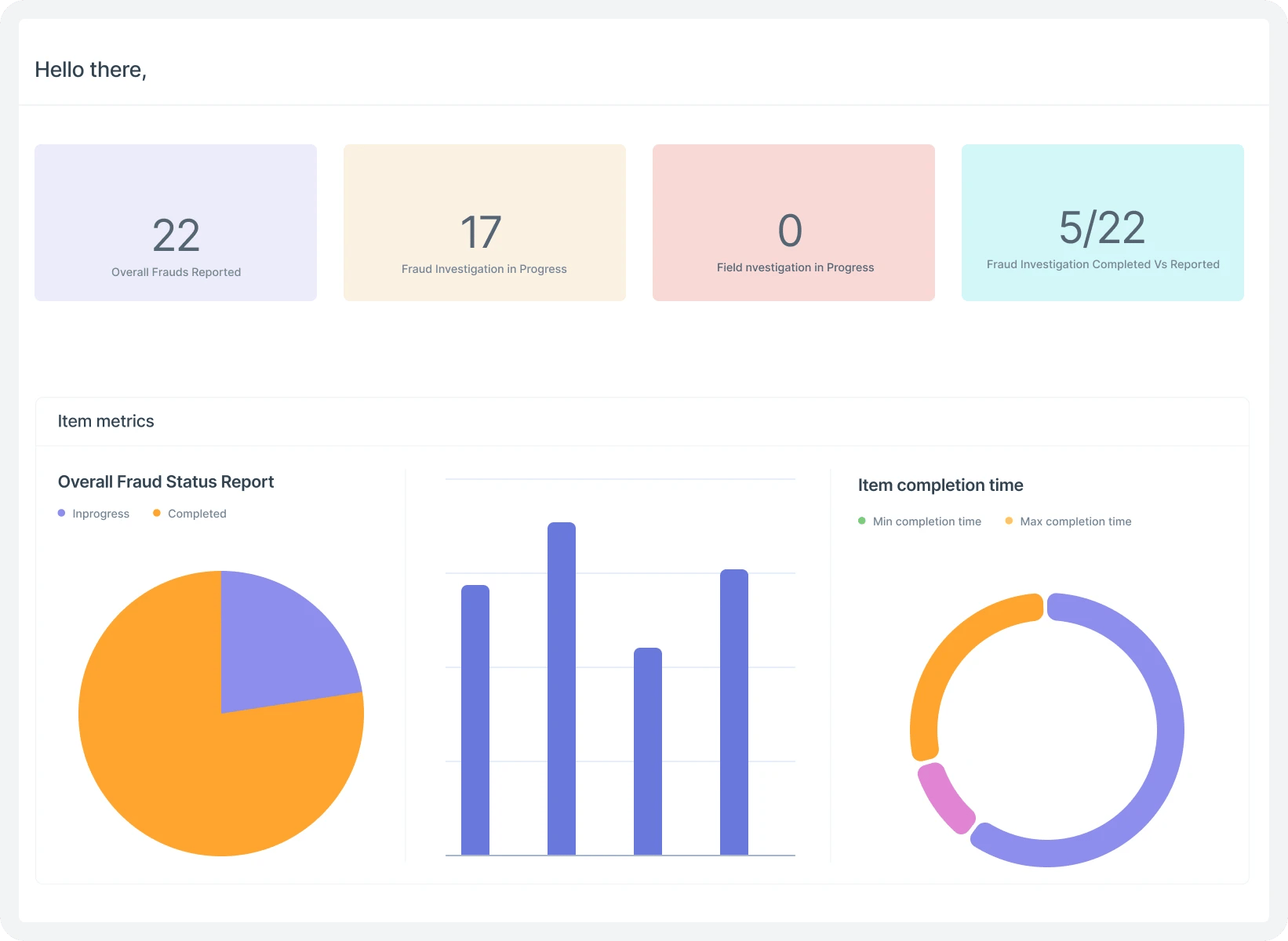

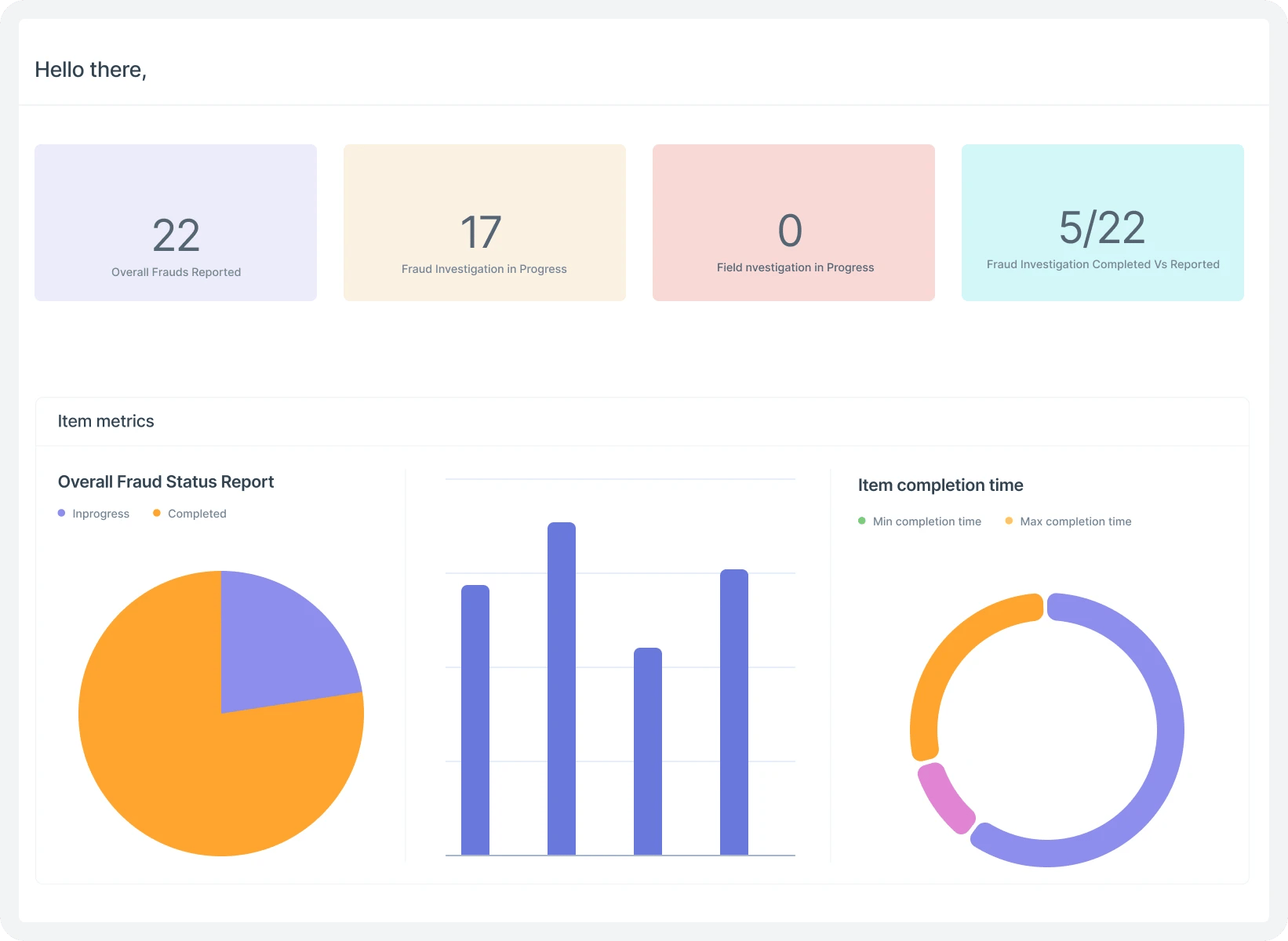

Build Comprehensive Dashboards

Create custom reports on transactions, claims, accounting data, customer and agent data

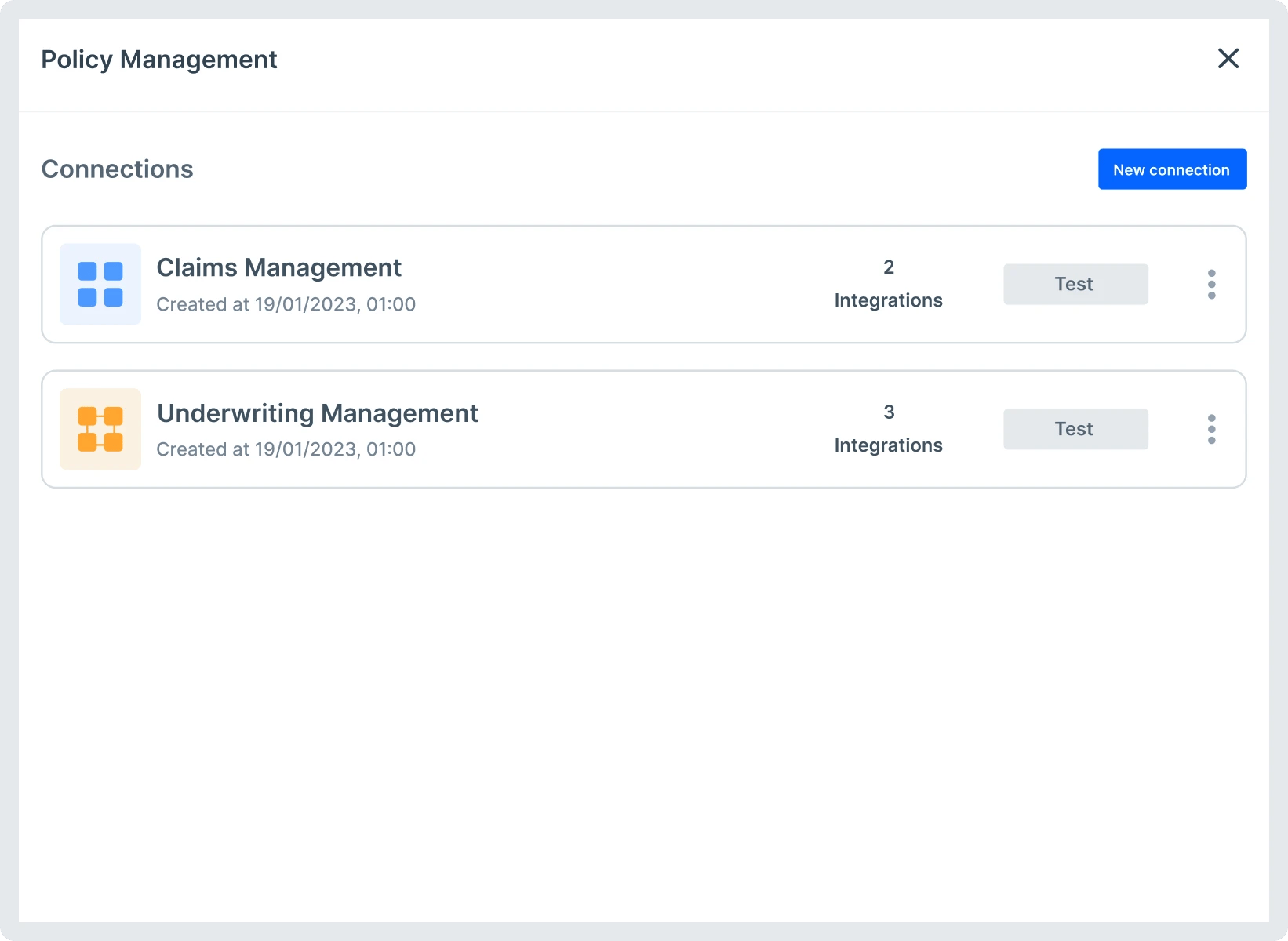

Integrate Seamlessly

Connect with distribution channels, customer and partner portals, and other insurtech systems

Build Mobile Apps

Enable claimants and your mobile workforce to access custom portals and forms through mobile apps

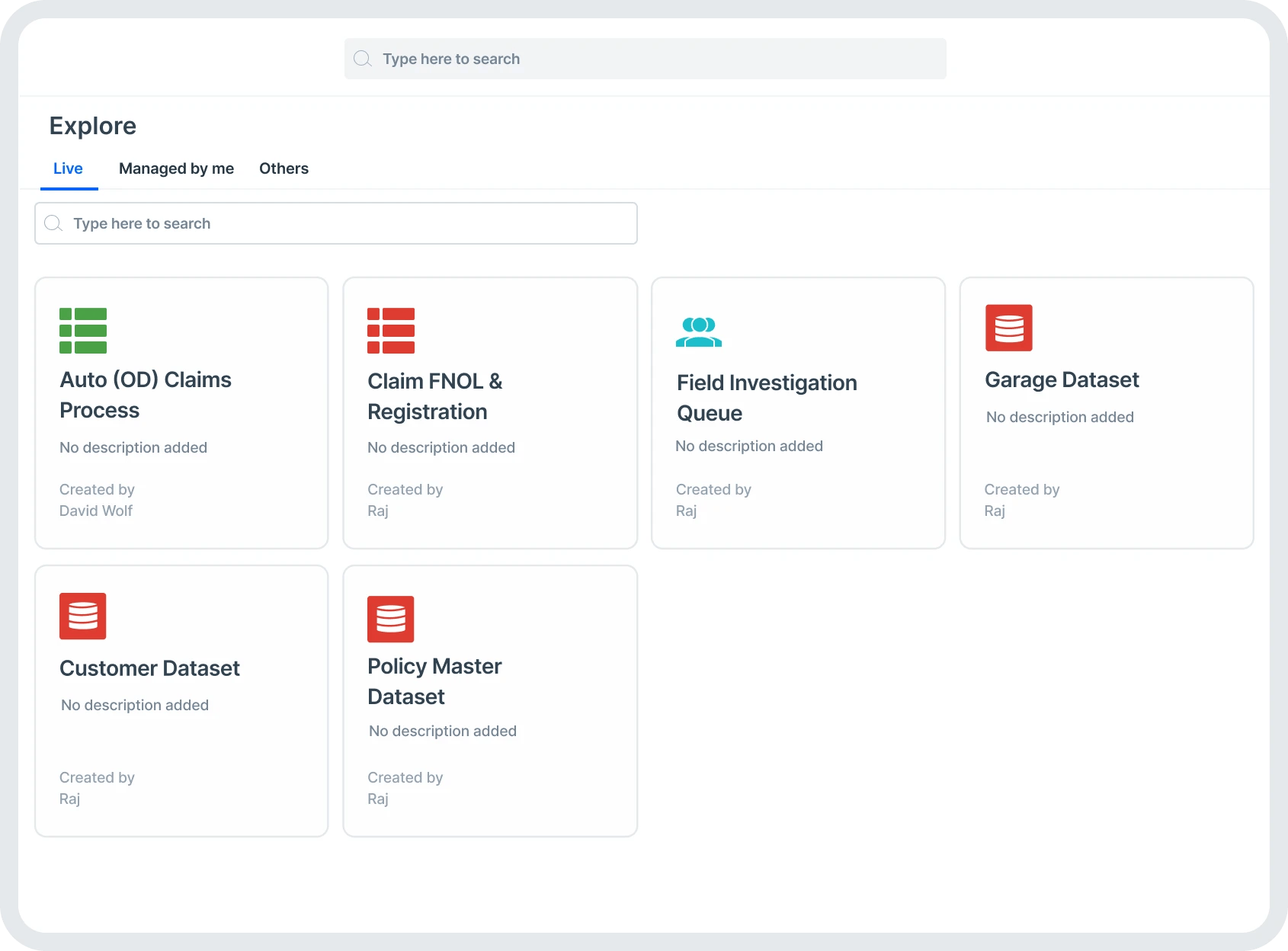

Tailor These Popular Insurance Apps

for Your Business

Claims Management

Build claims and settlement workflows to receive, investigate, and resolve claims automatically for faster closure

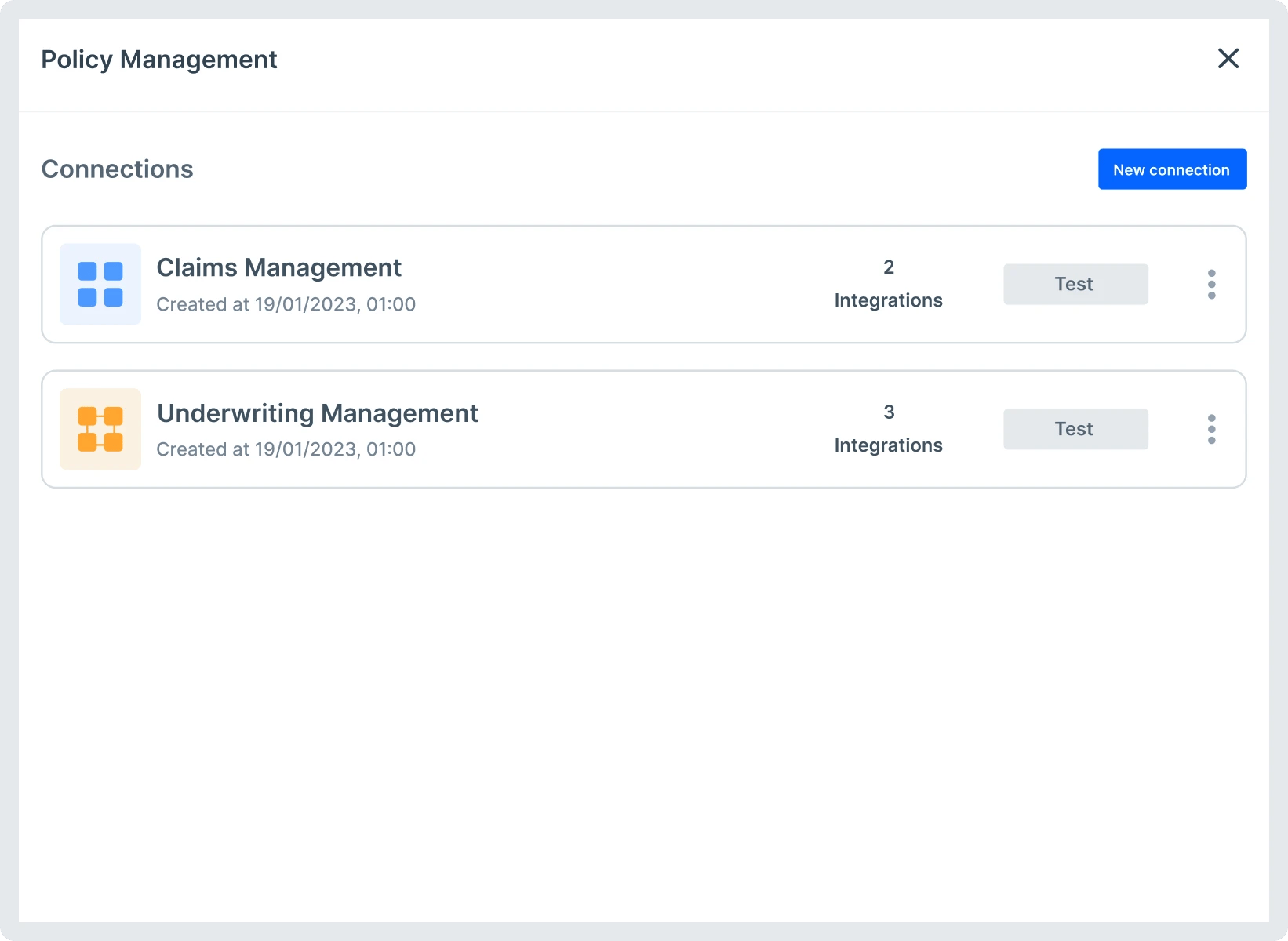

Policy Management

Build processes to review, approve, and deliver a repository of policies. Monitor the performance of the policy management process

Underwriting Management

Define rules and policies that calculate insurance premiums, define rating rules, create auditable document trails, and do more